Newsletter #112 – Increases/bonuses, payslip, housing, new CSE login and teleworking survey

Increases, bonuses, profit-sharing and participation

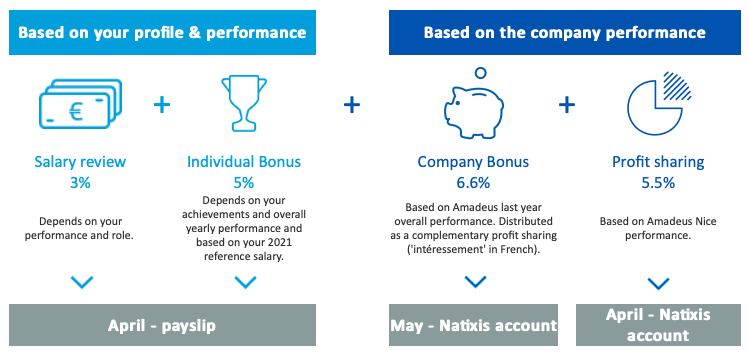

In April you will see the increase and the individual bonus on your pay slip

- The increase, announced at an average of 3%, varies according to the position and the market.

- The individual bonus is calculated based on your performance in 2021. The average is 5% for a “WE – Within Expectations” rating.

In case of an “EE – Exceeding Expectations” or “OP – Outstanding” outperformance for Global Grade >= 11 (ex-level 8), an additional bonus is granted.

There are two options:

- Placement in Amadeus shares (+10% with no charges). Find out more with the simulator.

- Immediate payment (with charges and income tax).

The profit-sharing is 5.5% for all, placed in the PEE blocked for 5 years and managed by Natixis (without charges or income tax).

In May you will receive the profit-sharing payment:

- The company bonus is 6,6% for all.

- The supplement is 1000 € Gross for all (confirmed during the March 25th CSE), considered to compensate the cost of fuel.

There are two options:

- Retrieve them immediately subject to charges and income tax

- Placement in PEE.

Understanding your payslip and taxes

As of January 2022 and with the implementation of Workday, the presentation of our payslips has changed. Here are some explanations to help you find the information you need.

Your profile

defined in the header of each payslip, with:

- Your unique 8-digit identifier is located at the top right-hand corner (in italic below the page number). As a reminder, this ID is useful for accessing the CSE website (see article “New login for the CSE website”).

- Your Employment « Emploi »

- Syntec Coefficient « Position, Coefficient », which correspond to your Global Grade at Amadeus

Your salary

The gross amount of your « Désignation »

It can be made up of:

- « Salaire de base » is your basic salary

- « Absence RTT ou CP ou autres acquis » is your “Absence from work or leave of absence or other entitlements” minored by any days not worked

- « Absence RTT ou CP ou autres acquis » is your “Payment for time off or leave or other entitlements” – all your payments for absences

- Votre « Prime de vacances » is your “Holiday bonus” linked to paid leave allowance – ICP, i.e. 10% of the “Earned CP payment

- Autres primes « on call », « prime de brevet » is your Other “on call” bonuses, “patent bonus”, more…

- “Bonus individuel” is your Individual bonus (paid only in April)

- « Avantage en nature surcomplémentaire » is your “Supplementary benefit in kind” employer’s contribution to the supplementary health insurance scheme, which today represents 1,85 €

« Salaire total brut » is your “Total gross salary” amount which is used as the basis for calculating the employer’s and employee’s contributions.

Your wage costs

They are in the “Employee share” column with the “rate” and “amount”. They are related to:

- « Santé (Health)»

- « Mutuelle » is your private health insurance, managed by Willis Towers Watson (former “Gras Savoye”), is a fixed amount of 57.25 € whatever your salary (45% of the global cost / 55% Amadeus) for the entire household,

- « Mutuelle surcomplémentaire » (supplementary health insurance), is a fixed amount of 2.26 € whatever your salary (55% of the global cost / 45% Amadeus) for the entire household.

- « Prévoyance TA » and « Prévoyance TB » managed by Malakoff are a participation of 50% based on social security bracket

- « Retraite (Retirement)»

- « Sécurité Sociale plafonnée (Pension)» and « Sécurité Sociale déplafonnée (Social Security capped)»

- « Complémentaire tranche 1 » and « Complémentaire tranche 2 » are supplementary pensions to the AGIRC-ARRCO fund

- « CET tranche 1 + 2 » CET-Technical Balance Contribution for any salary above the social security ceiling.

- « Retraite supplémentaire T1 (Supplementary pension T1)», « Retraite supplémentaire T2 (Supplementary pension T2) » and « Retraite supplémentaire (Supplementary pension T3)» are private pensions known as Article 83, managed by SOCEGAP. 50%-50% participation employee-Amadeus.

- Autres (Other) :

- « Unemployment insurance: APEC » (Agence Pour l’Emploi des Cadres) is a contribution to the unemployment insurance for managers

- Other contributions due by the employer) are made of various lines on CSG and CSG/CRDS (taxes)

Employer’s contributions are in the last column “Employer’s share” with just an amount. They are related to « Health », to « Occupational injuries – Diseases », « Retirement pensions», « Unemployment insurance » and « Other contributions due by the employer ».

The last part (after the blue line “TOTAL CONTRIBUTIONS AND CONTRIBUTIONS”) depends on:

- « Transport allowance zone 1 » or « Transport allowancezone 2 » or « Transport allowance»

- Type of transport: Bus, Car, other…

- If you live in Zone 2: DO NOT FORGET to check the “car allowance” when filling in your presence in Workday

More info : Transportation allowance, Transportation allowance – Bel Air, Transportation allowance – Mainsite

- « Teleworking allowance » More info

- « Réintégration CSG CRDS abondement PEE »

- «SMP deduction» Share Match Plan

- « Reprise avantage en nature surcomplémentaire » is the amount put in the gross amount for the calculation of the salary charges

Summary

at the bottom of each page of the pay slip

- « Congés (Leave)» « Acquis (Accrued)», « Pris (Taken)» and « Solde (Balance)» of your paid leave and time off

- « CP Acquis (Accrued CP) » from June N-2 to May N-1, 30 days per year and to be taken before May N

- « CP Ancienneté (Seniority CP) » +1 day every 5 years, 6 days maximum. Credited at the end of the month of the seniority date.

- « CP En cours (CP in progress) » from June N-1 to May N to be taken before May N+1

- « RTT » from June N-2 to May N-1 in order to have 216 days worked over this period. Credited June N-1 and to be taken before August N. For information 9.5 RTTs will be credited in June 2022.

- Amounts

« Gross », « SS Ceiling » Social Security, « Net fiscal », « PAS » Prélèvement À la Source for income tax and “Retraite Suppl.” art. 83- for the monthly « Period »

- and for the « Year » : year-to-date since January 1st of the current year

Housing Commission

A meeting of the Housing Commission took place on March 10th. On this occasion, Nathalie Le Bris presented Action logement and the new website.

Points of contact for Action logement team:

- Accession to properties: Elisabeth Schlosser

- Financing advice: Olivier Perugini (helps putting together the file and referral to banking services for loans).

The main areas of Action logement team are the following:

- Housing assistance:

- Purchase: Advice, financing and housing offers. Loan of €40,000 at 0.5% over 25 years (purchase of a new main residence, social housing or old HLM housing). Possibility of obtaining an additional €10,000 depending on resources.

- Renting: Social or intermediate housing offer, financing of the guarantee deposit or by being a guarantor for your landlord.

- Financing of works:

- Energy renovation: Loan of €10,000 at 1% over 10 years

- House extensions: Loan of 20,000 € at 0.5% over 20 years

- Useful investment for landlords:

- Simplified contact and proposal of labelled salaried candidates.

- 100% free guarantee to secure rental income.

- Help for young people:

- Temporary accommodation offer.

- LOCA-PASS advance: €1,200 to finance the security deposit.

- VISALE guarantee: a 100% free guarantor.

- My job My accomodation aid: €1,000 to help with settling in.

- Coping with financial difficulties:

- Personalized support for accessing or maintaining housing.

Housing project in mind? Feel free to contact the experts, they can help and support you!

Here is the calendar of the Amadeus Action Logement 2022 duties. It remains to be defined when the face-to-face meetings will resume.

CSE web site: new login

- Since March 23rd, in order to continue and benefit from the advantages of the CSE, please note that “Employee ID Workday” (8 digits) becomes the login for the CSE web site.

There are 2 options to find it:

- On the top right of the payslip (in grey and italic, just below page number).

- In Workday, click on the profile icon (top-right corner) > View Profile.

Your Employee ID appears in the “Job Details” section (right-hand side).

The password remains unchanged.

You must accept once again the terms and conditions.

No change of login for early retirees or pensioners.

Example:

- Your former Employee ID and CSE login was YYYYY.

- Today your Employee ID and CSE login is 0000XXXX.

CFDT-F3C-COVID national survey: New work organisations, what impacts?

COVID crisis has had a major impact on the world of work. We are obviously referring to the implementation of teleworking for certain categories of staff, but not only.

The health crisis may also have resulted in organisational changes or changes in working conditions for all employees (working hours, organising of work spaces, access to training, relations between team members, etc).

The survey is open to everyone!vise à effectuer un premier bilan.

We count on you, thank you for your participation!