Newsletter #126 – Teleworking and transportation allowance negotiations

- 11 September 2023

Do not hesitate to contact us for any further information

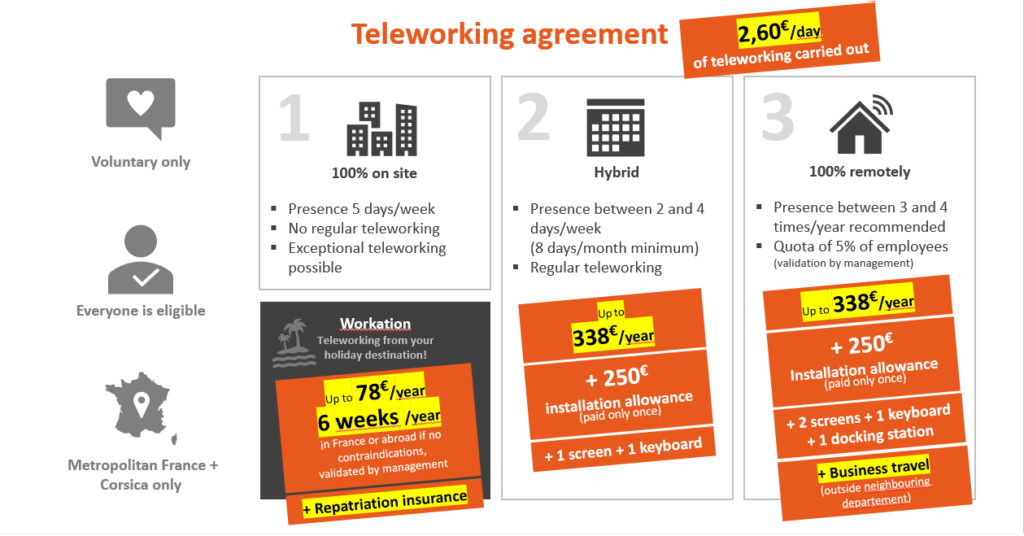

Teleworking negotiations

At the current stage of discussions, the following arrangements have been agreed with management:

Since mid-July, we have been waiting for an amendment to the current agreement to be proposed for signature.

Information of current teleworking

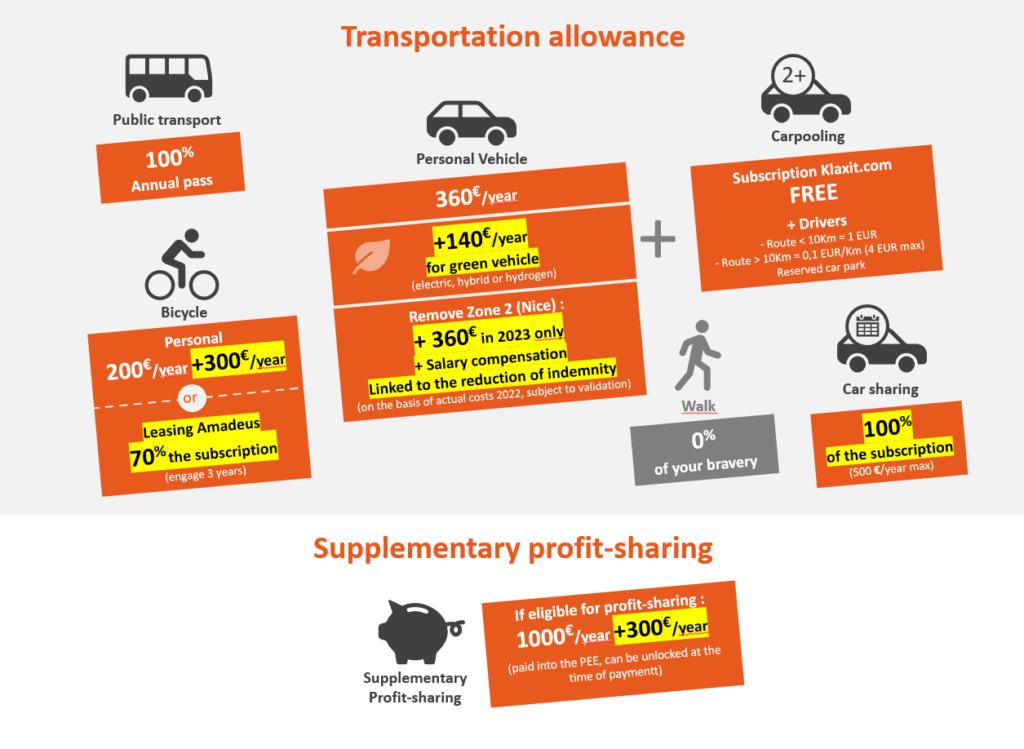

Transportation allowance negotiations

The negotiations have not led to the signing of an agreement, but to a unilateral decision by the company. Nevertheless, thanks to the analysis of the hundreds of individual situations that you have communicated to us, the CFDT was able to obtain suitable compensation conditions for all employees.

Following discussions with management, we have arrived at the following arrangements:

Information of current transportation allowance

Additional information:

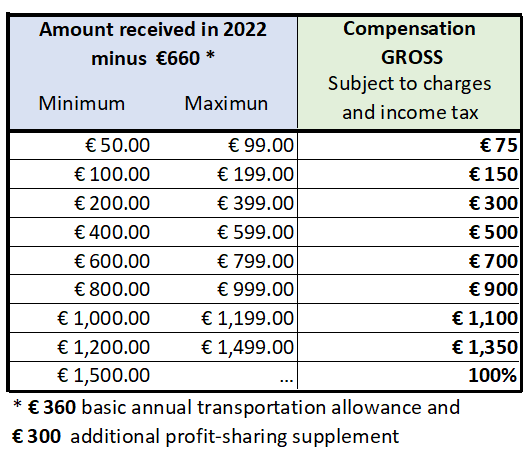

- From 2023, a profit-sharing supplement must pass to €1,300 annual (to be received by the end of the year) instead of €1,000 today.

- Full remote mode

- Personal vehicle package for the following departments:

- For Nice: 06 and 83

- ForParis: 75, 77, 78,91,92, 93, 94, 95

- For Strasbourg: 67 and 68

- Business travel expenses for other departments

- Personal vehicle package for the following departments:

- Sustainable Mobility Package €500/year (details on the URSAFF website) :

- Included:

- Electric, hybrid or hydrogen personal vehicle

- Carpooling via the Klaxit platform

- Personal bike

- Car sharing of electric, hybrid or hydrogen vehicle (including scooter, excluded electric scooter)

- Excluded:

- Personal transport device (electric scooter, electric segway, unicycle or motorized skateboard)

- Bike leased from Amadeus

- Included:

- The public transport pass subscription is reimbursed at 100% without limitation.

- Gross annual salary compensation following the abolition of Zone 2 for Nice employees:

We have thus obtained permanent individual compensations, which will be subject to employer and employee contributions. The employee may feel that he is suffering a net loss, but this integration into the salary will have several positive effects:

- In the short term, annual increase::

- Paid leave allowances

- Individual bonus

- Incentive (company bonus)

- Profit Sharing

- In the short term, annual increase::

- In the long term, the improvement of your retirement pension

- CARSAT retirement insurance

- Complementary ARGIC-ARCOO

- Private SOGECAP – Art 83

- In the long term, the improvement of your retirement pension

We remain at your disposal to help you check that you will fully benefit from this system and to ensure that this advantage is not eroded on the occasion of your next “Salary Review” (moderation of salary increases).